Tax Planning & Preparation

Strategic Tax Services that Make a Difference at Year End

Mitigating your tax burden is always a core goal. This is best achieved through comprehensive tax planning. Whether you’re a sole proprietor or operate a multi-tiered corporation or partnership, we pledge to provide you with quality, up-to-date tax return preparation and advice. Our experienced tax specialists excel at tax planning and preparation for individuals and businesses.

Our dedication to you doesn’t stop after April 15. We work with you throughout the year to develop a highly personalized plan with tax-saving strategies that are tailored to your unique circumstances. We are diligent about keeping current on the changing tax laws that affect you, and we are committed to examining all the tax-saving opportunities available to you. We will minimize your tax liabilities and maximize your future opportunities—while remaining in full compliance with IRS statutes.

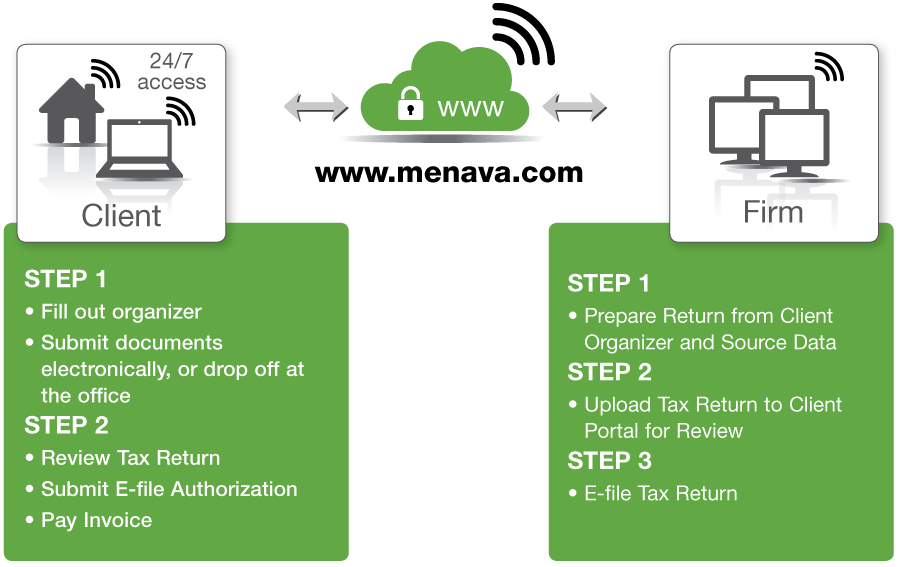

To make the tax process as convenient and pain-free as possible, we provide you with a secure portal on our website where tax documents can be reviewed and electronically housed. You have 24/7 access to all your financial information via the internet, and you can track the status of your e-filed return.